Impressive Info About Is Labor Included In WIP

Decoding WIP

1. Understanding Work-in-Progress (WIP)

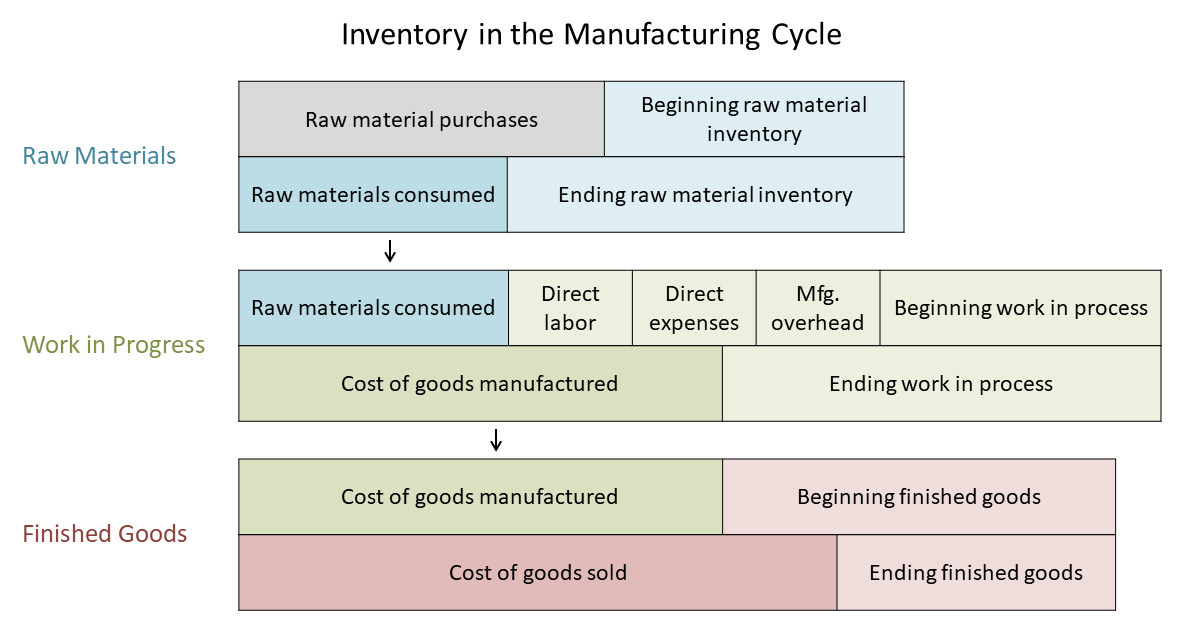

Ever wondered what happens to all those half-finished products swirling around in a factory or the partly completed projects sitting on a consultant's desk? That's Work-in-Progress, or WIP for short. It's essentially all the inventory that's currently being transformed into a finished good or service. Think of it as the limbo state for projects and products — not quite raw materials anymore, but not yet ready for sale.

From a bean-counting perspective (or accounting, if you prefer the less folksy term), WIP is a crucial part of a company's assets. It represents an investment of resources, and tracking it accurately is vital for understanding profitability and making sound business decisions. Underestimating WIP can paint a rosier (but ultimately inaccurate) financial picture, while overestimating it can lead to missed opportunities. Finding the right balance is key.

WIP isnt just about tangible items, though. It also encompasses the value added during the production process. This is where things get interesting, and where labor costs come into play. So, the real question is, does this labor gets factored into all the WIP?

Imagine a carpenter diligently working on a custom-made table. The wood itself is a raw material, but the carpenter's skills and effort are transforming that wood into something much more valuable. That's where labor comes in. It's not just about the raw materials; it's about the human effort that's shaping them.

The Labor Question

2. Direct Labor's Definite Inclusion in WIP

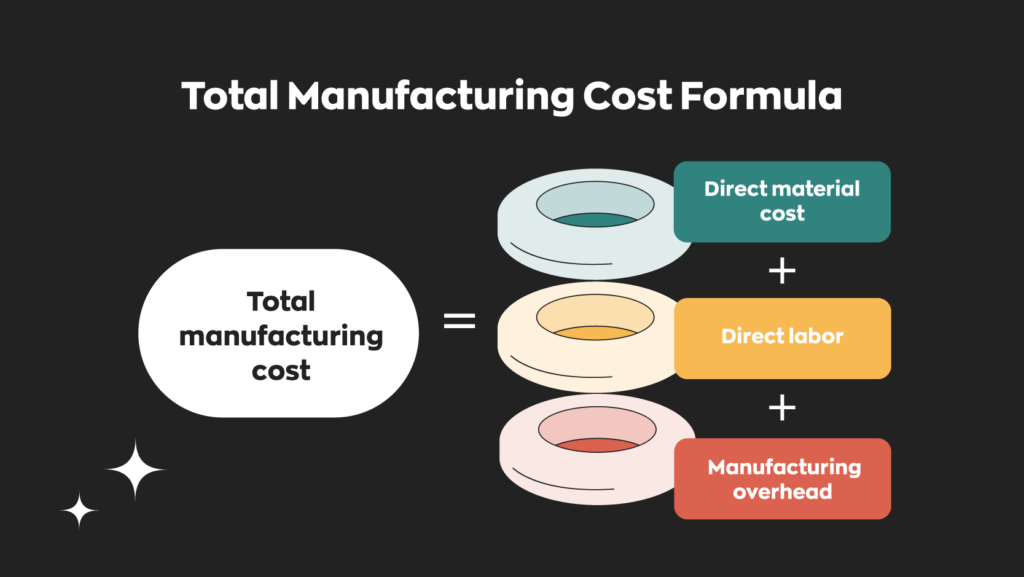

Okay, let's cut to the chase: generally, yes, labor is included in WIP. Specifically, we're talking about direct labor. Direct labor refers to the wages and benefits paid to employees who are directly involved in the production process. These are the folks on the assembly line, the chefs creating culinary masterpieces, or the programmers writing code. Their contributions are easily traceable to specific products or projects.

The logic behind including direct labor is pretty straightforward. It's a significant cost associated with turning raw materials into finished goods. Leaving it out would significantly understate the true cost of production and distort the value of WIP. Think of it like baking a cake: you can't just count the cost of the flour and sugar; you also have to account for the baker's time and effort.

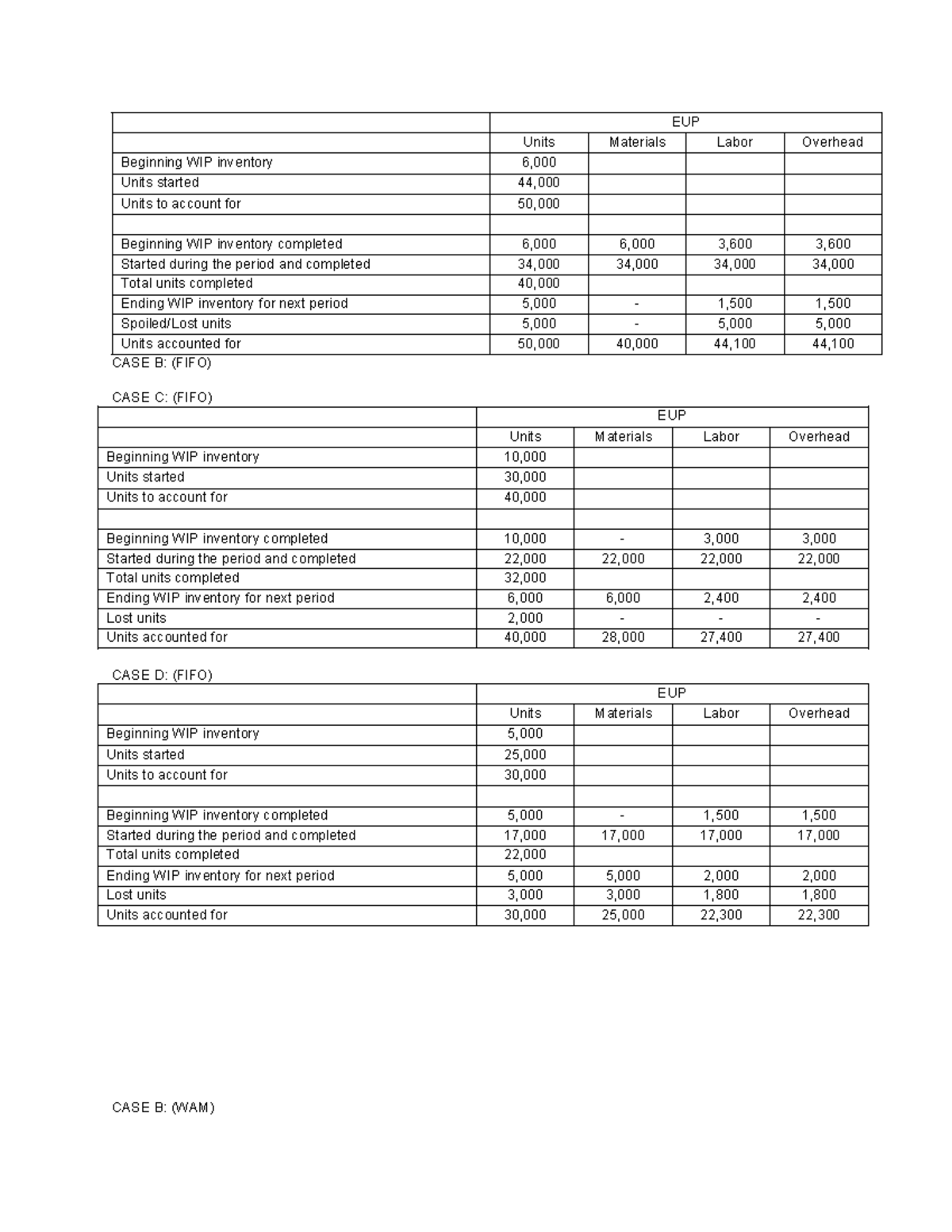

However, it's not always a black and white decision. The method of accounting and the specific nature of the business can influence how labor costs are allocated. For example, in some cases, it might be more practical to allocate labor costs based on estimated time spent on each project rather than meticulously tracking every minute.

Different accounting methods, such as standard costing or activity-based costing, can also influence how labor costs are allocated to WIP. The key is to choose a method that accurately reflects the cost of production and provides meaningful information for decision-making.

Indirect Labor

3. When Indirect Labor Joins the WIP Party

Now, what about indirect labor? This is where things get a tad more complicated. Indirect labor refers to employees who support the production process but aren't directly involved in creating the product. Think of the factory supervisor, the maintenance crew, or the quality control inspectors. Their work is essential, but it's harder to directly link their efforts to specific products.

The inclusion of indirect labor in WIP depends on the company's accounting practices and the materiality of the costs. Some companies choose to allocate indirect labor costs to WIP, while others treat them as period expenses (meaning they're expensed in the period they're incurred). There's no one-size-fits-all answer here.

If indirect labor costs are significant, it's generally considered good practice to allocate them to WIP. This provides a more accurate picture of the total cost of production. Common allocation methods include using overhead rates or activity-based costing to distribute indirect labor costs across various products or projects.

But if the costs are relatively small, the administrative burden of allocating them might outweigh the benefits. In such cases, it might be simpler and more practical to treat indirect labor as a period expense. The decision ultimately depends on the company's specific circumstances and accounting policies.

Capital Cycle Wip

Practical Examples

4. Labor in Different Industries

Let's bring this to life with a few examples. Imagine a custom furniture maker. The carpenter's wages (direct labor) are definitely included in WIP. The cost of the sandpaper and glue (indirect materials) might be included as well. And depending on the company's policies, a portion of the workshop supervisor's salary (indirect labor) could also be added to the WIP value for each piece of furniture.

Now, consider a software development company. The programmers' salaries (direct labor) are a major component of WIP for each software project. The project manager's salary (indirect labor) might also be allocated to WIP, especially if they spend a significant amount of time directly managing the development process. The cost of the coffee and snacks that keep the programmers fueled? Probably not included in WIP.

Or, think about a construction company building a house. The wages of the bricklayers, plumbers, and electricians (direct labor) are all included in WIP. The salary of the site supervisor (indirect labor) would likely be allocated to WIP as well. Even the cost of renting equipment is factored into the equation.

These examples illustrate how labor costs, both direct and indirect, play a significant role in determining the value of WIP across different industries. The specific methods used for allocating these costs may vary, but the underlying principle remains the same: to accurately reflect the total cost of production.

Calculate Your Cost Of Goods Manufactured With This Formula

Why It Matters

5. The Ripple Effect of Correct WIP Data

So, why is it so important to get the labor component of WIP right? Well, accurate WIP valuation has a ripple effect throughout the entire financial reporting process. It impacts everything from the balance sheet to the income statement, and ultimately, the bottom line.

An accurate WIP calculation ensures that a company's assets are fairly represented on the balance sheet. This is crucial for investors, lenders, and other stakeholders who rely on financial statements to assess the company's financial health. Understating WIP can make the company look less profitable than it actually is, while overstating it can create a false sense of security.

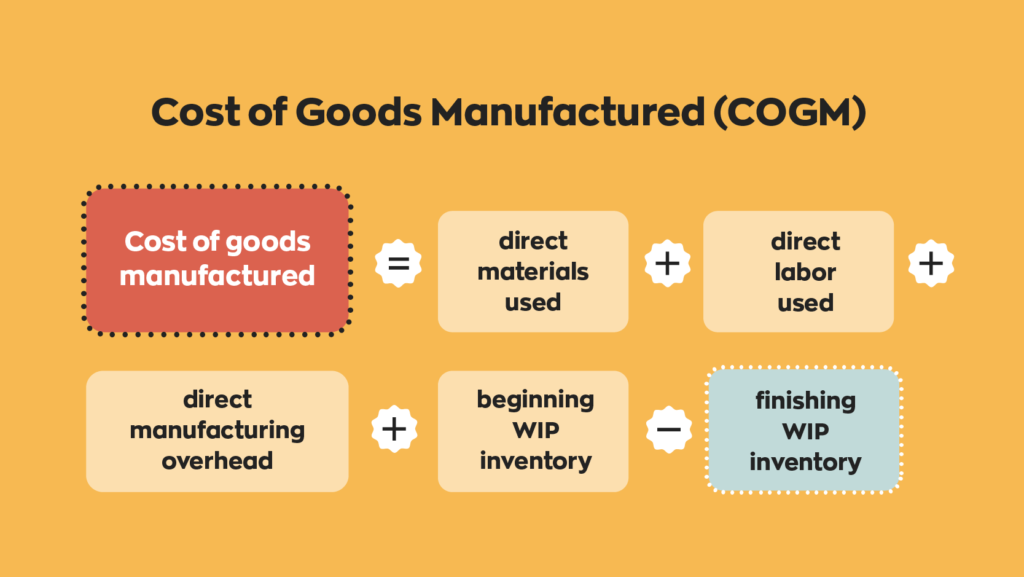

Furthermore, accurate WIP valuation is essential for calculating the cost of goods sold (COGS), which directly impacts the income statement. COGS represents the direct costs associated with producing the goods that a company sells. By accurately including labor costs in WIP, companies can arrive at a more accurate COGS figure, which in turn affects their gross profit and net income.

Ultimately, accurate WIP valuation provides valuable insights for decision-making. It helps companies understand the true cost of their products, identify areas where they can improve efficiency, and make informed pricing decisions. Ignoring the labor component of WIP is like trying to navigate a ship without a compass — you might end up in a very different place than you intended.

FAQ

6. Your Burning WIP Questions Answered

Still got questions about labor and WIP? Here are a few common ones:

7. Question

Answer: Forgetting to include labor in WIP will understate the value of your assets and distort your cost of goods sold, making your company appear less profitable than it truly is.

8. Question

Answer: No, there's no single "right" way. The best method depends on your company's specific circumstances, accounting practices, and the materiality of the costs involved. Common methods include using overhead rates or activity-based costing.

9. Question

Answer: Yes, labor costs associated with rework or fixing defects should generally be included in WIP, as they are part of the overall cost of bringing the product to a finished state.

10. Question

Answer: The frequency of WIP valuation depends on the industry and the specific needs of the business. However, most companies will value WIP at the end of each accounting period (monthly, quarterly, or annually).

11. Question

Answer: Direct Labor is directly and tracably involved in creating the product, whereas Indirect labor support the production process but aren't directly involved in creating the product.